Money Expert > Car Insurance > Why has my car insurance doubled?

Why has my car insurance doubled?

Last updated: 30/04/2025 | Estimated Reading Time: 9 minutes

Money Expert > Car Insurance > Why has my car insurance doubled?

Last updated: 30/04/2025 | Estimated Reading Time: 9 minutes

If you’ve gone to renew your car insurance and been shocked by a jump in price, you are not alone. Since May 2021, average UK car insurance prices have skyrocketed by 82%, with some drivers reporting that their premiums have more than doubled in price.

Why is this happening? Well, there are a number of contributing factors that make this price hike surprisingly complex.

Below are some of the most important contributing factors which have driven up the price of car insurance overall.

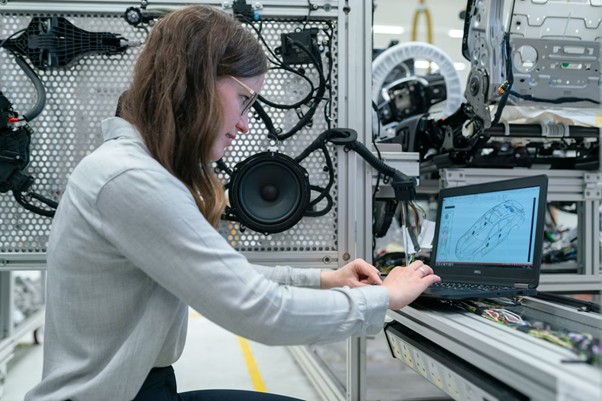

From parking sensors to AI driver assist and collision detection systems, modern vehicles are jam-packed with advanced technology. These features are great for safety, comfort, and ease, but they also make modern cars harder to maintain and to fix when they break down.

Rather than simple repairs that anyone with basic mechanical skills can handle, modern cars require sophisticated electrical and computer engineering experience, along with costly components such as chips and motherboards.

For example, repairing a bumper on an older car is a simple job. In a worst-case scenario, the bumper will have to be taken off and replaced with a new one. However, a newer car with sensors and cameras in its bumpers is a lot more complicated. The same bumper repair that was so fast and inexpensive for the older car could run into thousands of pounds for the newer car.

This rise in repair costs means that insurers may have to pay out more when cars are damaged, which in turn means car insurance prices have almost doubled.

Since 2021, the cost of living in the UK has risen sharply. Almost every industry has been affected by higher prices and squeezed margins. Car-related industries like auto mechanics, petrol stations, and vehicle manufacturers have all felt the pressure of rising costs and have had to raise their own prices in response.

As materials like steel, aluminium, and microchips become ever more expensive, repair costs rise as well. And the more a vehicle costs to repair, the more it costs to insure.

At the same time, supply chain disruptions as well as worldwide conflict and tariff issues have caused longer wait times for parts. This means that insurers have to supply courtesy cars more frequently and for longer periods. This increases insurer costs, which are ultimately passed on to customers in the form of higher car insurance premiums.

According to the ABI, car insurers dealt with 2.4 million insurance claims in 2024, with the average claim hitting an all-time high of £5,300. As the amount being paid out for claims increases, the overall risk profile for insurance providers gets worse. Unfortunately, this means a hike in car insurance premiums across the board.

It’s illegal to drive without car insurance in the UK, but an increasing number of drivers don’t seem to have gotten this message.

Illegal, uninsured driving has a big impact on all drivers. When an uninsured driver causes an accident, insurers have to cover the costs and compensate the victims through the Motor Insurers’ Bureau (MIB). These costs ultimately get passed on to insured drivers via higher car insurance prices.

In 2022, the FCA (Financial Conduct Authority) banned ‘loyalty penalties’ in which customers renewing their car insurance were charged more than new customers.

On paper, this move should protect long-term policyholders from unfair price hikes and result in generally cheaper car insurance costs. In practice, however, the market adjusted to compensate for insurers no longer attracting new customers with cut-price deals. Pricing levelled out, and many saw their car insurance prices rise to match the real cost of coverage.

‘Crash for cash’ scams involve fraudsters deliberately staging accidents in order to claim insurance payouts. Fake injury claims, exaggerated damages, and so on all contribute to insurer losses.

This kind of fraud has seen a huge rise across the UK in recent years. In order to combat this, insurers are investing heavily in fraud prevention measures. Unfortunately, rising costs for insurers almost always translate into rising insurance costs for consumers, and this is no exception

While rising car insurance costs are often blamed on wider market changes, it’s worth taking a moment to look closer to home. Sometimes, the real reason your premium has doubled is down to you, and small, everyday changes in your life that quietly shift how insurers see your level of risk.

You might not think much of moving to a new area, updating your job title, or racking up a few extra miles on your commute. But, from an insurer’s perspective, each of these things can slightly raise the likelihood of a claim. And when those small changes stack up, the result can be a noticeably higher quote

Here are a few personal shifts that might be influencing your renewal price:

On their own, none of these changes might seem like a big deal. But together, they can have a compounding impact—quietly nudging your risk level higher in the eyes of your insurer, and unfortunately, that can mean a higher quote when renewal time rolls around.

As we’ve seen, car insurance costs have increased significantly in recent years, but it may not actually be as bad as the numbers make it appear.

It’s important to remember that this 2021 rise launched from an extremely low baseline. Car insurance prices plummeted in 2020 as lockdowns kept drivers off the roads. In mid-2020, car insurance prices fell to their lowest since 2015 as car use (and therefore car accidents) declined.

So, while it appears that car insurance has doubled as drivers took to the roads after lockdown, it isn’t as dramatic as it seems. Much of the price increase can therefore be attributed to a return to the ‘normal’ level of vehicle usage post the lockdowns.

That’s not to say that car insurance prices aren’t unusually high. They are. But the statistics can be misleading without context.

It’s hard to fight back against external price-hike factors like rising cost of living and higher fraud rates, but there are factors within your control that can mitigate the damage to your purse. Here are a few things you can do to save money and get affordable car insurance policies:

Car insurance costs have almost doubled thanks to a perfect storm of factors like a rise in insurance fraud and the cost of living crisis. However, while these external factors are largely beyond consumer control, there are ways you can bring your car insurance costs down to a reasonable level.

One of the best possible ways to beat the price hikes and get affordable car insurance premiums is to compare car insurance quotes and providers with MoneyExpert. You could save hundreds of pounds simply by searching our database for a quote that fits your needs. Compare car insurance providers today to find the perfect premium for you.